1-800-805-5783

1-800-805-5783

Artificial intelligence is no longer optional in finance; it’s essential. Banks, insurance companies, and investment firms now rely on AI agents in finance to reduce costs, mitigate risks, and enhance customer service. These agents are not simple bots. They learn, adapt, and act independently to handle complex financial processes that once required teams of people to manage.

In this blog, you’ll see precisely how AI agents transform financial services. You’ll also gain insight into their challenges, benefits, and potential future impact.

AI agents are autonomous systems that analyze data, reason, and act toward specific goals. Unlike static automation scripts, they learn from every interaction.

For example, when you apply for a loan, an AI agent checks your credit history, income patterns, and even digital behavior. It then determines whether you qualify more quickly and often more accurately than traditional scoring models.

Key traits of AI agents in finance include:

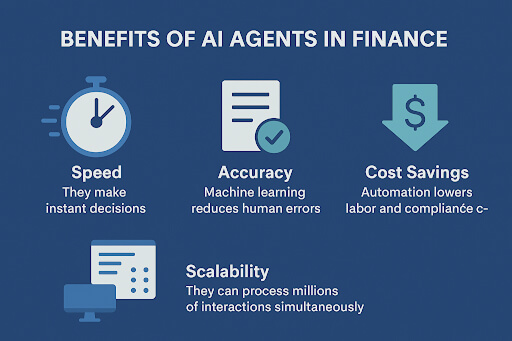

You already know finance depends on precision and trust. Errors or delays can result in significant losses. AI agents solve this by bringing speed, accuracy, and scalability.

According to a 2025 McKinsey report, the adoption of AI in banking is expected to generate $1.2 trillion in annual value. AI agents will lead much of that gain by automating processes, enhancing compliance, and improving customer engagement.

A study predicts that AI-driven financial platforms will manage over $2 trillion in assets within the next decade. That’s proof of how fast institutions and customers trust these systems.

Fraud detection once depended on manual checks. Now, AI agents scan thousands of transactions per second. They flag suspicious activity instantly, reducing losses and protecting customers.

A 2024 study found that AI-based fraud systems reduce false positives by 60%, resulting in millions of dollars in savings on compliance costs.

Traditional models miss valuable insights. AI agents consider a wider range of data: bill payments, spending habits, and even alternative credit histories. You get faster loan decisions, and banks reduce default risk.

AI agents power robo-advisors that build tailored portfolios. They adjust recommendations based on market conditions and your financial goals.

Compliance tasks drain resources. AI agents automate monitoring, reporting, and flagging potential breaches. This not only cuts costs but also lowers the risk of regulatory fines.

AI-driven chatbots handle customer queries instantly. From checking balances to explaining loan terms, they free human staff for more complex cases.

Here are some of the benefits of AI agents in the finance industry.

Adoption isn’t risk-free. Here are the main concerns:

If training data is biased, the AI agent’s decisions reflect that. A biased model could unfairly reject loans or mislabel transactions.

Financial regulators demand clarity. Banks must explain why an AI agent rejected a loan. Black-box models create legal and ethical risks.

AI systems become high-value targets for hackers. Financial institutions need strong safeguards against manipulation.

Expect AI agents to become even more intelligent and more independent. In the next five years:

Gartner’s 2025 forecast states that by 2027, 80% of financial institutions will use AI agents for at least one mission-critical task.

AI agents are no longer confined to research labs or pilot projects. Leading financial institutions have already deployed them in real-world scenarios, proving their value with measurable results. Let’s look at some concrete examples that show you how AI agents in finance operate today.

HSBC faces the challenge of monitoring millions of transactions every day to comply with anti-money laundering (AML) regulations. Manual reviews were overwhelming and costly. The bank deployed AI agents that analyze transaction data in real time, detecting suspicious activity more effectively than rule-based systems.

According to HSBC’s 2024 compliance report, this approach cut false positives by 30–40%. That reduction translates into millions saved in operational efficiency costs because staff no longer waste time chasing harmless transactions. At the same time, the system enhances detection accuracy, making it more difficult for malicious actors to evade detection.

HDFC Bank in India uses AI-driven credit scoring models to serve rural communities where traditional credit histories are limited. Farmers, small shop owners, and first-time borrowers often struggle to access formal banking because they lack conventional financial records.

AI agents change this. They analyze alternative data, such as payment patterns, crop cycles, and mobile phone usage, to evaluate creditworthiness. Loan officers then use these insights to quickly approve applications.

The result is faster rural loan approvals and increased financial inclusion for communities that were previously underserved by mainstream banking. By adopting AI agents, HDFC Bank not only expands its customer base but also reduces default risk with more accurate lending decisions.

These cases prove one thing: AI agents in finance deliver real, measurable impact. Whether it’s saving hundreds of thousands of hours, cutting compliance costs by millions, or opening doors for new borrowers, the benefits are clear. Institutions that follow these leaders gain efficiency, trust, and a competitive edge.

The use of AI agents in finance and accounting is not about the future but about today. They handle fraud detection, credit scoring, compliance, and customer service with unmatched speed and accuracy. They save costs, scale services, and deliver personalized solutions.

Financial institutions that embrace AI agents now will gain a long-term advantage. Those who delay risk falling behind in an industry that rewards speed and trust.

1. What are AI agents in finance?

They are autonomous systems that analyze financial data, make decisions, and automate tasks like fraud detection, loan approvals, and customer support.

2. How do AI agents help banks?

They reduce fraud, expedite loan approvals, enhance compliance, and deliver personalized services.

3. Are AI agents safe to use in finance?

Yes, but institutions must use strict cybersecurity and monitoring to prevent misuse.

4. Can AI agents replace financial advisors?

They complement human advisors by handling routine tasks and offering personalized suggestions, but humans still provide judgment and trust.

5. What is the future of AI agents in finance?

They will manage decentralized finance, handle real-time stress testing, and support global regulatory monitoring.

At [x]cube LABS, we craft intelligent AI agents that seamlessly integrate with your systems, enhancing efficiency and innovation:

Integrate our Agentic AI solutions to automate tasks, derive actionable insights, and deliver superior customer experiences effortlessly within your existing workflows.

For more information and to schedule a FREE demo, check out all our ready-to-deploy agents here.