1-800-805-5783

1-800-805-5783

Insurance has always been complicated. Claims take too long, policies confuse people, and support lines frustrate customers. In 2025, that’s not acceptable anymore.

Your customers want quick answers, clear terms, and hassle-free claims. That’s where agentic AI in insurance steps in. Unlike older AI tools that only follow rules, agentic AI takes action, learns from each case, and makes real-time decisions.

The result? A smoother, faster, and more transparent insurance journey for your customers.

Customer expectations in insurance have shifted dramatically in just a few years. People now value speed, transparency, and personalization more than low premiums alone.

The “old way” of handling policies and claims—manual reviews, paperwork, and endless waiting—is no longer sustainable. Competitors already use agentic AI applications in insurance to close this gap, and customers notice.

Nobody wants to wait weeks for a payout. Agentic AI in insurance scans claim documents, validates information, and approves straightforward cases in minutes. Customers get their money faster, and insurers save on manual labor.

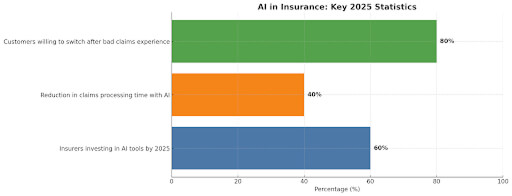

Example: An insurer in Europe reported a 40% cut in claim resolution time after rolling out AI-assisted adjudication in 2024.

Agentic AI in insurance assistants is active 24/7. Unlike traditional chatbots, they don’t just give scripted replies. They learn from customer intent, offer real-time answers, and even escalate to human agents when needed.

Insurance jargon frustrates customers. Agentic AI in insurance breaks down coverage details into simple, personalized explanations. That builds trust and avoids disputes.

Fraud screening is essential, but it usually slows claims. Agentic AI in insurance runs checks in the background, allowing genuine customers to receive fast approvals while flagging risky cases for deeper review.

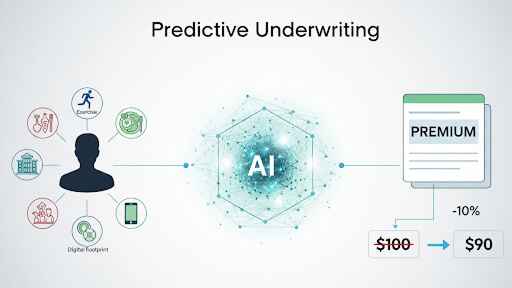

Instead of generic packages, AI studies your lifestyle, purchase history, and risk profile to suggest policies that make sense for you.

If a delay happens, the AI doesn’t stay silent. It notifies customers early, preventing frustration and reducing call-center traffic.

Agentic AI in insurance runs predictive models to estimate the likelihood of high-cost claims. This helps insurers balance premiums while protecting customers.

For straightforward claims like flight delays or minor auto damage, AI handles the entire process instantly—no back-and-forth paperwork required.

“Agentic AI transforms insurance from reactive firefighting to proactive service. Customers notice the difference immediately.” — Dr. Karen Li, Insurance Technology Analyst.

Signing up for insurance is usually a slow process. With agentic AI, customers get guided onboarding, instant ID checks, and real-time policy recommendations.

Instead of waiting in the dark, customers track claims in real-time. They see what’s approved, what’s pending, and when payouts are expected.

AI doesn’t just spam you with “renew now” emails. It reminds customers at the right time, with the right product fit, increasing retention.

Traveling soon? AI suggests short-term travel insurance. Buying a car? It highlights auto coverage. This isn’t upselling—it’s relevant, helpful advice.

“In 2025, the winners in insurance won’t be the ones offering the cheapest premiums. They’ll be the ones delivering seamless, AI-driven customer experiences.” — Michael Torres, Customer Experience Strategist.

Imagine filing a car accident claim. Instead of paperwork, you upload photos. Agentic AI in insurance cross-checks images with policy coverage, verifies police reports, and approves payment—all within minutes.

In 2024, a U.S. auto insurer reported that 60% of minor claims were settled in under 24 hours using agentic AI in insurance workflows.

Agentic AI in insurance analyzes medical histories, lifestyle habits, and wearable device data to suggest personalized health insurance packages.

This isn’t just about tailoring coverage—it prevents overpaying for unnecessary add-ons while ensuring essential services are included.

Insurance fraud costs the industry $80 billion annually in the U.S. alone. Agentic AI in insurance detects anomalies across claims instantly—flagging suspicious activity before payouts happen.

Unlike static fraud models, it adapts daily as fraud tactics evolve.

Instead of waiting for disasters, insurers can now warn customers ahead of time. For example:

This shifts insurers from reactive payout handlers to active partners in risk prevention.

Insurance has long been criticized for complex policies, opaque processes, and slow service. But that model is breaking down.

Today’s customers expect:

Fail once, and people switch. A 2024 Forrester survey found that 80% of policyholders change providers after just one poor claims experience.

That’s where agentic AI in insurance changes the game. Unlike static AI models, agentic AI doesn’t just analyze data. It acts, adapts, and learns in real-time—delivering experiences that finally match customer expectations.

Agentic AI assistants don’t just “answer questions.” They handle end-to-end service flows—like helping you compare policies, file a claim, and track approval in one conversation.

Customers hate legal jargon. AI converts policy language into plain English summaries specific to a customer’s case.

This reduces disputes later and increases trust at sign-up.

In 2025, people interact with insurers across apps, web, phone, and chat. Agentic AI in insurance ensures consistent responses everywhere. You don’t get different answers depending on which channel you use.

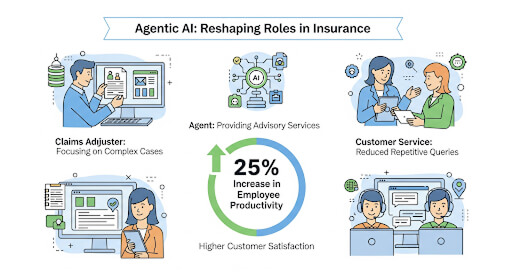

Agentic AI in insurance doesn’t replace every role—it reshapes them.

According to McKinsey (2025), insurers using AI effectively see a 25% increase in employee productivity alongside higher customer satisfaction.

Most insurers already use some form of automation. But automation alone doesn’t fix broken customer experiences.

Agentic AI in insurance goes further:

This means instead of just “chatbot answers” or “automated emails,” you get interactive, problem-solving systems that actively reduce effort for customers.

By 2027, Gartner predicts that 40% of insurance interactions will be handled entirely by agentic AI systems.

Agentic AI in insurance is not just a trend. It’s the new standard for how insurers interact with customers.

It speeds up claims, provides clear communication, detects fraud without causing delays, and personalizes every interaction. By 2025, customers will expect these AI-driven services as the norm.

For insurers, the choice is simple: adopt agentic AI in insurance now—or risk losing customers to those who already have.

1. What exactly is agentic AI in insurance?

It’s AI that not only processes data but acts on it—making autonomous decisions in claims, support, and policy management.

2. How does agentic AI improve customer service in insurance?

It delivers faster claims, personalized policy support, real-time updates, and simpler communication.

3. What are the main agentic AI use cases in the insurance industry?

Claims adjudication, fraud detection, risk modeling, policy personalization, and customer onboarding.

4. Does agentic AI replace insurance agents?

No. It handles repetitive tasks so agents can focus on high-value, complex customer needs.

At [x]cube LABS, we craft intelligent AI agents that seamlessly integrate with your systems, enhancing efficiency and innovation:

Integrate our Agentic AI solutions to automate tasks, derive actionable insights, and deliver superior customer experiences effortlessly within your existing workflows.

For more information and to schedule a FREE demo, check out all our ready-to-deploy agents here.